However on the other side of the counter, elements of the hospitality sector are expected to feel the financial pinch.

Many cafe, restaurant and bar owners believe the change will increase business costs, while the hurried nature of the rollout makes adjusting to the new system difficult. A more complicated tipping structure also has the potential to reduce the frequency of tipping by customers.

Rising costs at point of sale

John Hart, the head of Restaurant and Catering Australia, says that in spite of belated discount offers on new machines from the banks, payment terminal expenses were still set to skyrocket.

"It is significantly increasing – probably tripling – the hardware costs each month," Hart said.

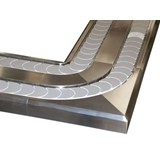

For years one terminal sufficed for most cafes and restaurants, but now merchants may require multiple wireless machines to ensure customers can pay at their table.

"Those range from $30 to $60 a month," Hart said of the payment terminal operating costs. "Then there's the cost of re-engineering things so they can get those terminals out to the tables in a way that doesn't inconvenience the customer."

Credit where it's not due

Wilma Meyer, who owns Essen Cafe & Restaurant in Campbelltown, Sydney, along with her husband Mike, believes it’s not only the terminal operating cost that is unfair to businesses.

"Signature or no signature, my main beef with this whole shift is that the banks are encouraging people to select 'credit' for payment with debit cards," Meyer said.

"That makes sense for the consumer, but the banks are charging us the higher credit card fees. We have a flat rate for savings but we pay an additional percentage for credit transactions. And with PayPass it automatically processes the payment as credit, which is unfair. We called the bank about it but the response was, ‘that’s the way banking in Australia is headed'."

Essen continues to rely on just one wireless terminal to take to the tables, so to combat the problem of overly drawn-out payments the restaurant recently stopped allowing split bills.

"We tried to keep it for as long as we possibly could, but when you have 15 separate transactions for a table of 20 people it’s just not feasible," Meyer said.

Fair warning?

Meyer says it is fruitless expecting banks or government to roll out these kind of initiatives in a way that allows businesses to adapt and seek clarification.

"Nobody is interested in me making money through my business; they're interested in taking a portion of what I make. Waiting for proper explanations to your concerns just leads to frustration."

No fraud, no problems

Meanwhile Lance Blockley from the Industry Security Initiative, the finance industry group executing the change, dismisses any concerns about PIN-only transactions and insists the reduction in fraudulent activity should appeal to all sections of the food service industry in the long run.

"Very few merchants take the trouble to compare the signature on the docket with the signature on the card, it's not a secure method of authorisation," Blockley said.

Tipping point of sale

For many venues, tips form an essential piece of the revenue puzzle and their importance shouldn't be undervalued. Tips help businesses attract and retain quality staff, which in turn improves the customer experience.

Perhaps the onus now falls on the cafes and restaurants themselves to find alternative methods that negate this obstacle.

"People can still enter a tip as part of the machine process if they want to, but we work differently to a lot of other restaurants in that all cash tips go into a jar and the total is divided up among the front-of-house and back-of-house staff, not management," Meyer said.

"We encourage quality service before people pay; you never know if you’re going to receive a tip or not.

"Having said that, our staff loses out on tips when one person pays the bill on card while the rest of the table gives that person cash. They will pay the exact amount on their card and keep all the cash."

Signing off

Will the fact customers no longer manually sign a deferred tip on the receipt lead to less frequent tipping in future? Will PIN-only payments represent a significant burden or a mere blip on the profit margin for hospitality operators?

While it's too soon to answer such questions definitively, one thing is certain - the industry has little choice but to ensure its POS approach is up to date.

-160x160-state_article-rel-cat.png)

-160x160-state_article-rel-cat.png)