Australia's total tourism market is expected to be worth $117.2 billion in 2014-15, according to industry analyst IBISWorld's new report.

The industry is benefitting as international travellers take advantage of the weakening dollar to visit Australia. Annualised growth of 1.9 per cent is forecast over the next five years, ahead of inflation, with revenue expected to reach $128.6 billion in 2019-20.

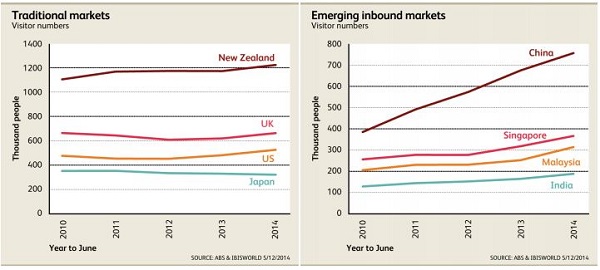

"IBISWorld expects inbound visitor numbers to Australia to grow by 6.0 per cent this financial year to total 7.1 million, with the majority of this growth coming from neighbouring countries including China, Malaysia, Singapore and India – all of which are growing faster as sources of tourists than our traditional inbound visitor markets," said IBISWorld industry analyst Ryan Lin.

Since mid-2013, the falling Australian dollar has been a key factor driving inbound tourism growth, as has the expansion of the middle classes and their incomes in emerging economies.

At the same time, traditional markets have felt the impact of poor economic conditions. Looking ahead, emerging economies are expected to continue to outpace traditional markets because of their greater scope for growth.

"With non-traditional tourism markets now driving growth across the sector, savvy businesses are expanding their services in a bid to attract the growing number of Asian tourists seeking luxury experiences during their stay," Lin said.

Looking at the motivation for visiting Australia, holidays – unsurprisingly – account for the largest proportion of visits, with growth in this segment significantly outpacing growth across other visitor categories including business, education, employment, and visiting family and friends.

The unique Australian landscape continues to be a major draw for visitors from established and emerging markets.

Operators in WA, the Northern Territory and Queensland are leveraging internationally renowned areas like the Great Barrier Reef, Uluru and the Kimberley to meet this demand.

Growing markets

As the Australian tourism sector is transformed by increasing inbound visitors from Asia, tourism operators are taking advantage of new revenue streams by adapting to the needs of new visitor groups.

The industry has previously developed services to cater to so-called independent tourists from major western economies like the UK, US and Germany. Independent tourists are often experienced travellers, tending to organise their own transport and accommodation, and are avid users of online tourism platforms.

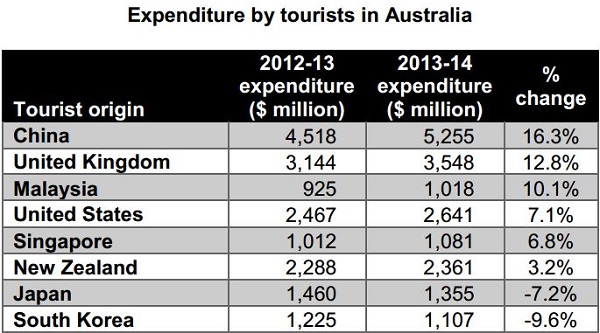

However, times are changing. In 2013, China overtook the United Kingdom as the second-largest source of visitors to Australia, with more than 671,000 arrivals. Chinese tourists have also been the biggest spenders since 2010, averaging $7418 per capita per trip in 2014. Korean tourists, however, stay the longest, with an average trip duration of 57 days.

"What is notable about emerging markets for Australia is that the culture of this tourism is still developing. Travellers from these markets have a greater propensity to pay for advice to cut down on the complexity of planning a foreign holiday," Lin said.

The travel agency and tour arrangement services industry is forecast to grow ahead of the total tourism market over the five years through 2019-20, at 2.0 per cent annualised, as participants expand their service offering to new markets.

Niche industries, such as the long distance bus transport industry, are targeting these visitors with packages anchored by transport in luxury, air-conditioned coaches. Conversely, the passenger car rental and hiring industry holds more appeal for independent travellers.

Retail and restaurants

Emerging visitor markets are also looking to take advantage of more luxurious travel options that allow them to make the most of their time in Australia.

"In line with the performance of premium hotels, internationally recognised and luxury brands have been the major winners from strong inbound tourism from Asia. Labels such as Louis Vuitton, Prada, Penfolds and UGG Australia are typical of the types of brands sought out by Asian tourists," Lin said.

Many businesses in the hospitality sector rely upon demand from tourists to supplement regular revenue from local patrons. In fact, tourist spending is expected to account for more than 30 per cent of revenue for restaurants and cafes.

"Enjoying the local cuisine is a major attraction for tourists, and a way to get in touch with the local culture," Lin said.

"And travellers have become increasingly important to food and beverage providers, with 14.5 per cent of tourist expenditure occurring in the restaurant and cafe sector."

Hotels and accommodation

Hotels and resorts account for the lion's share of accommodation revenue, generating an estimated $6.3 billion in 2014-15. This is compared with $3.1 billion for serviced apartments, $2.9 billion for motels and $1.0 billion across holiday houses, flats and hostels.

Upper tier accommodation is providing a stronger source of revenue than lower level offerings, perhaps because many inbound travellers – especially those from Asia – are seeking memorable, premium experiences.

IBISWorld forecasts annualised growth of 3.1 per cent for serviced apartments in the five years through 2019-20, ahead of 2.3 per cent annualised growth for hotels and resorts, 1.9 per cent for motels and a 0.6 per cent annualised decline for holiday houses, flats and hostels.

"Lower priced accommodation options face growing competition from platforms like Air BNB, which allows users to access informal and cost-effective accommodation services," Lin said.

-160x160-state_article-rel-cat.png)